The provision of company cars to employees has gradually declined over the years because of the painful tax charges that often apply for the employee. The tax charge is based on the cost (list price) of the car when new and its carbon dioxide (CO2) emissions. The higher the emissions, the higher the percentage of the list price that is taxed each year. If a company car has high emissions the employee can be taxed on as much as 37% of the list price of the car every year. However, last year the government announced their intention to encourage the uptake of electric cars by introducing favourable tax rules for both full battery electric cars and plug-in hybrid electric cars. This, combined with the ongoing improvements to range and charging times, makes electric cars and plug-in hybrids a much more attractive option to business owners contemplating a change of cars or considering whether to introduce them into their remuneration package for the first time.

For the current tax year there will be no company car tax at all for fully electric cars and, going forwards, the tax charge will be based on just 1% of list price in 2021/22 and 2% in 2022/23. These favourable rates will also apply to plug-in hybrids that have an electric range greater than 130 miles, although higher percentages apply for hybrids with a lesser electric range.

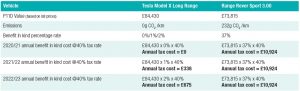

The effect of going electric is best illustrated with an example:

An employee, who is a 40% taxpayer, has the choice between a (fully electric) Model X Tesla and a (diesel) Range Rover Sport 3.00. The comparison of the tax is as follows:

There are other benefits for electric and hybrid cars:

Capital allowances

Cars with CO2 emissions of less than 50g/km are eligible for 100% first year capital allowances. This means the business can deduct the full cost of the car from pre-tax profits in the year of purchase.

Road tax

Vehicle road tax is based on carbon dioxide emissions. New fully electric cars are exempt from both first year road tax and the ongoing road tax charges.

Congestion charge

Electric cars are also exempt from the congestion charge tax – another saving for those needing to drive into central London.

Everything seems to be moving in the right direction for electric cars. Prices are becoming more competitive, ranges and charging times are improving and the tax breaks are attractive – not to mention the saving of the planet!

If you would like to discuss the tax aspects of purchasing cars through your company, please contact Charles Green on 020 8652 2450 or email crg@clarksonhyde.com